Understanding Your Break-Even Point: The Key to Business Success

Running a successful business requires not only passion but also a deep understanding of your financial metrics. One of the most critical calculations every entrepreneur needs to master is the break-even point. This essential figure tells you how much revenue you need to generate to cover your costs—no profit, no loss—just a solid foundation for sustainable growth.

Once you’ve calculated your break-even point, check your profit margins using our Profit Margin Calculator.

Why Use a Break-Even Calculator?

- Make Data-Driven Decisions: Stop guessing about pricing and sales targets. With our Break-Even Calculator, you’ll get precise numbers to guide your business strategies.

- Control Costs: Identifying your break-even point helps you pinpoint areas where you can cut costs and boost profitability.

- Evaluate New Ideas: Planning a new product launch or service? This calculator helps you determine if it’s financially viable.

- Set Realistic Goals: Understand what’s achievable within your current market and resources.

Break-Even Calculator

Results

Break-Even Quantity:

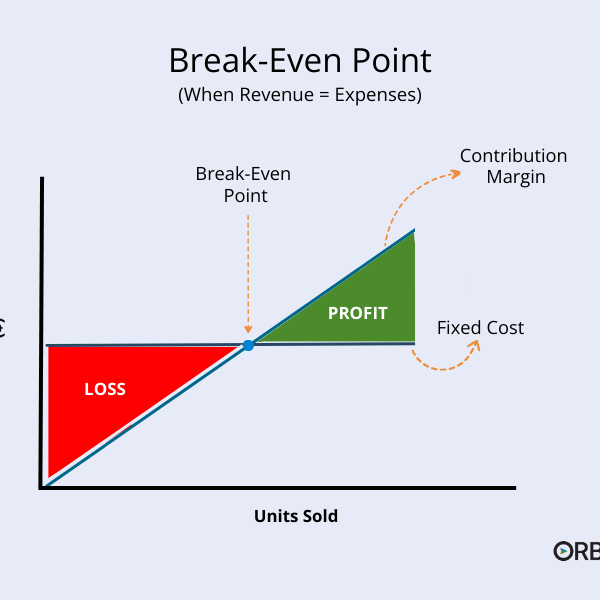

What is a Break-Even Point?

The break-even point is the exact moment where your total revenue equals your total costs. In simple terms, it’s the minimum you need to sell to avoid losses. By calculating this, you can make informed decisions about pricing, expenses, and production levels.

For example:

- If your fixed costs (like rent, salaries, and utilities) are high, you’ll need to sell more units to break even.

- If your variable costs per product increase, your break-even point shifts higher, requiring more sales.

How to Use the Calculator

- Enter Fixed Costs: Include expenses like rent, salaries, and insurance that don’t change with production levels.

- Enter Variable Costs: These are costs that vary per unit, such as materials, packaging, and labor.

- Enter Price Per Unit: The amount you charge customers for each product or service.

- Click Calculate: The calculator will instantly show you the number of units you need to sell to break even.

Tips for Optimizing Your Break-Even Point

- Lower Fixed Costs: Negotiate lower rents or find cost-effective ways to manage overhead.

- Increase Price Per Unit: If your market allows, consider adjusting pricing to improve margins.

- Reduce Variable Costs: Streamline production processes or source materials at lower prices to reduce unit costs.

Why It Matters

Knowing your break-even point empowers you to operate with confidence. Whether you’re pitching to investors, managing day-to-day finances, or planning for growth, this calculator is a cornerstone of financial literacy.

Start Calculating Your Success Today!

Use our Break-Even Calculator now and take the first step toward making smarter, more profitable business decisions.

Disclaimer

The Break-Even Calculator is a tool designed to provide general guidance and insights based on the inputs you provide. It is intended for informational and educational purposes only and should not be considered as financial, legal, or professional advice.

While we strive for accuracy, the results generated by this calculator depend entirely on the data you enter and may not account for all variables or unique circumstances of your business. Always consult with a qualified financial advisor or accountant to analyze your specific situation and to make decisions that best align with your business goals.

The use of this calculator does not create a client relationship, and we are not liable for any financial decisions or outcomes resulting from its use. By using this tool, you acknowledge and agree that you are solely responsible for any actions taken based on the information provided.