Debt-to-Income (DTI) Ratio Calculator: Understand Your Financial Health

Your debt-to-income (DTI) ratio is one of the most critical factors lenders consider when evaluating your loan application. A lower DTI ratio signals financial stability and better loan eligibility, while a higher ratio may indicate potential financial strain. Use our Debt-to-Income Ratio Calculator to gain valuable insights into your financial health and make informed decisions.

Planning to buy a home? Calculate affordability with our Home Affordability Calculator.

How to Use the DTI Calculator

- Enter Your Monthly Gross Income:

- Include your total income before taxes and deductions.

- Input Your Recurring Debts:

- Add your monthly mortgage or rent payment, car loan payment, credit card minimum payments, and other recurring debts.

- Click “Calculate”:

- Instantly see your DTI ratio as a percentage and receive actionable insights into your financial health.

Debt-to-Income (DTI) Ratio Calculator

Results

Debt-to-Income Ratio (DTI): %

What Is the Debt-to-Income Ratio?

The debt-to-income ratio measures the percentage of your gross monthly income (before taxes) that goes toward paying your debts. It’s calculated as follows:

Lenders use this ratio to assess your ability to manage monthly payments and repay loans. A lower DTI ratio increases your chances of loan approval and may qualify you for better interest rates.

Why Is Your DTI Ratio Important?

- Loan Approval:

- A lower DTI indicates you’re financially stable, improving your chances of loan approval.

- Interest Rates:

- Borrowers with a lower DTI often receive more favorable interest rates.

- Financial Awareness:

- Knowing your DTI ratio helps you make informed decisions about taking on new debt.

- Debt Reduction:

- Understanding your DTI ratio can motivate you to reduce your debt and improve your financial situation.

How to Use the DTI Calculator

- Enter Your Monthly Gross Income:

- Include your total income before taxes and deductions.

- Input Your Recurring Debts:

- Add your monthly mortgage or rent payment, car loan payment, credit card minimum payments, and other recurring debts.

- Click “Calculate”:

- Instantly see your DTI ratio as a percentage and receive actionable insights into your financial health.

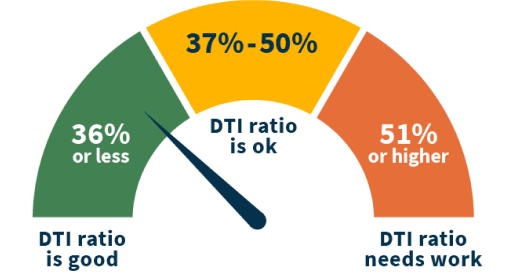

What the Results Mean

- DTI Below 36%:

- Excellent! Most lenders view this as a healthy DTI ratio, indicating financial stability.

- DTI Between 36% and 43%:

- Acceptable. While lenders may still approve your loan, it’s advisable to reduce your debt to improve your ratio.

- DTI Above 43%:

- Risky. This high DTI ratio may limit your loan options and result in higher interest rates. Focus on reducing debt to improve your financial health.

Tips to Improve Your DTI Ratio

- Pay Down Debt:

- Focus on paying off high-interest debt like credit cards to reduce your monthly obligations.

- Increase Your Income:

- Explore ways to increase your income, such as freelancing, part-time work, or negotiating a raise.

- Avoid New Debt:

- Hold off on taking out new loans or credit until you’ve lowered your DTI ratio.

- Consolidate Debt:

- Consider consolidating high-interest debts into a single loan with a lower interest rate.

- Budget Wisely:

- Use a budget to track your expenses and allocate more funds toward debt repayment.

Frequently Asked Questions

Q: What is considered a good DTI ratio?

A: A DTI ratio below 36% is generally considered excellent, while ratios up to 43% are still acceptable for many lenders.

Q: Does the calculator include all types of debts?

A: The calculator focuses on recurring debts like mortgage, car loans, and credit card payments. Be sure to include all debts that affect your financial obligations.

Q: How can I improve my DTI ratio quickly?

A: Paying down debt and avoiding new credit are the fastest ways to improve your DTI ratio.

Q: Will this calculator help me get approved for a loan?

A: While the calculator provides valuable insights, loan approval depends on multiple factors, including your credit score and lender requirements.

Take Control of Your Finances

Understanding your debt-to-income ratio is a vital step in managing your finances and achieving your financial goals. Use our Debt-to-Income Ratio Calculator today to gain clarity on your financial standing and take the first step toward reducing debt and increasing loan eligibility.

Disclaimer

Disclaimer: The Debt-to-Income (DTI) Ratio Calculator is a tool designed for informational purposes only. The results provided are estimates based on the information you input and do not constitute financial advice or guarantee loan approval. Actual loan eligibility and terms depend on various factors, including lender criteria, credit history, and additional financial information. For personalized advice, consult a qualified financial advisor or lender.